Credit allows you to borrow money or buy things now on the understanding that you’ll pay for them later, typically with interest added. This can be anything from taking out a mortgage on your home, taking out an overdraft or paying for a supermarket shop on your credit card.

Your ability to get credit depends on a few different things like your income and credit record – whether you have a history of taking credit and making repayments on time. Your credit rating is represented by a credit score, which can go up or down.

There are different ways to get credit for different reasons

Overdraft

Attached to your current account, an overdraft can act as a temporary safety net should you run low on funds or have cash flow issues. Although it can be very useful for unexpected expenses, you shouldn’t rely on your overdraft as part of your account balance.

Interest rates tend to be higher than with credit cards, so paying off as much as you can as soon as you can, will reduce how much you pay in interest.

✅ Useful safety net

✅ Always available (up to an approved limit)

❌ Not for regular or long-term borrowing

❌ High interest rate (when used)

Examples: Utility bill, cash flow management

Credit card

A credit card is a convenient and flexible form of credit. It’s mostly used for everyday stuff, from buying business supplies and groceries to petrol or plane tickets.

Your credit card provider will set a limit on how much you can spend. Before you apply be sure to carefully check the summary box, as interest rates can vary a lot between cards and some come with annual fees.

✅ Manageable & flexible repayments

✅ No interest on purchases if paid off in full by the payment due date each month

✅ Rewards programmes & incentives like cashback

❌ Not for long term borrowing

❌ Can take a longer time to repay if you only make minimum payments

Examples: online shopping, groceries, flights or holidays

Personal or business loan

A bit like a mortgage, a loan is when you borrow a set amount of money and pay it back in fixed instalments over an agreed amount of time, typically with interest. The big difference is that loans can be unsecured as well as secured. Unsecured means the lender doesn't use your assets as collateral against the loan.

Loans can vary enormously from lender to lender, so it’s wise to check the interest rates, fees and repayment terms very closely before taking one.

✅ Unsecured loans available

✅ Fixed monthly payments

✅ Lower interest rates for borrowing over longer periods

❌ Some lenders have unfavourable terms

❌ Not suitable for smaller loans or short term borrowing

Examples: Buying a car, House renovation

Mortgage

A mortgage is defined as secure credit. It refers to when you borrow a large amount of money from a lender to buy a property, using that property as collateral against the loan. The size of mortgage you can borrow will depend on your credit score alongside many other factors.

The interest rate is usually lower than with short term credit and you make repayments in regular instalments, usually monthly, over a long period of time. There are several types of mortgages available with fixed or variable interest rates and different ways to repay.

✅ Access to large sums for major purchases

✅ Lower interest rates than short term credit

❌ Secured against the value of the property

❌ Long term repayment commitment

Examples: A house / flat, business premises

‘Buy now, pay later’

A relative newcomer to the credit scene are financing companies. You’ve likely seen them pop up at the payment stage when you buy stuff online.

You can use them to buy the items in your shopping cart now and pay in fixed instalments (usually shown in the checkout) over a set amount of time. There’s typically no interest attached, but if you miss a repayment you’ll be charged a fee.

✅ Breaks down costs into manageable chunks

✅ No interest if repayments made on time

❌ Easy to overuse

❌ Late payment fees can be significant

Examples: Pair of shoes, office chair

Want to know more about different types of credit? MoneyHelper has answers.

Responsible credit from Cashplus Bank

Our personal and business credit products are designed to offer financial support when you need it. All Cashplus credit products are subject to eligibility as part of our responsible lender commitment.

Personal account credit add-ons

From a straightforward overdraft to our Creditbuilder service, we offer eligible customers easy to use credit add-ons that can help build your credit score.

Business account credit add-ons

Cash flow can be an issue for any business. We offer a range of business credit add-ons to help prepare your business for the unexpected.

Common questions about credit, answered

-

An interest rate tells you how high the cost of borrowing is or how high the rewards are for saving.

If you’re borrowing money (like using credit), the interest rate is the amount you’re being charged, shown as a percentage of the total amount you borrowed. If you’re saving money, it tells you how much you’ll be paid as a percentage of your total savings.

Let’s take an example: if you borrow £100 and the annual interest rate is 30%, after one year you would owe £130.

Credit cards can have different interest rates depending on what you use them for, with standard purchases usually being cheaper than if you use your card for withdrawing cash.

If the interest rate has ‘(variable)’ after it, the rate can change over time depending on different influences such as economic change.

-

APR stands for Annual Percentage Rate.

This is a standardised term that describes the annual rate of interest as well as any fees you might need to pay as a borrower. Interest + Fees = APR. The higher the APR, the more expensive the loan or credit card will be.

You’ll find your APR on your Pre-Contract Credit Information and Credit Agreement.

There are two types of APR:

- Representative APR - All banks and lenders use Representative APR. When you see this term, it means that interest rate has been given to at least 51% of customers who apply successfully. It’s a useful comparison tool.

- Personal APR - This is the actual interest rate you are offered. This could be the same as, higher or lower than the Representative APR depending on your personal circumstances.

-

APR and EAR are both acronyms used to describe how much it costs to borrow money, but they’re calculated in different ways.

- APR stands for Annual Percentage Rate. It’s the advertised interest rate that banks and lenders use to help customers compare the cost to other types of borrowing.

- EAR stands for Equivalent Annual Rate. It’s the interest rate you would actually pay over the course of a year factoring in compound interest (which is interest on the interest).

EAR doesn’t include separate fees and charges you might have to pay, but APR does.

-

A Representative Example is designed to show the typical costs a credit product might come with. You’ll see them wherever you see adverts for credit products like credit cards, overdrafts, loans and mortgages.

- Overdraft Representative Example

We include this in our overdraft offers, and on our website, to show what the ‘Total payable’ cost for the overdraft might be over the course of a three-month period.

Representative Example

Credit limit of £500, interest rate of 48.38 p.a. (variable), representative EAR 59.9% (variable), annual fee £50, total payable £574.75

- Credit card Representative Example

You’ll see this in all our credit card offers, and on our website, to show you what the ‘Total payable’ cost of your credit card could look like.

Personal Credit Card

Representative APR 39.9% (variable), Purchase rate 39.9% p.a. (variable), Assumed credit limit £1,200

This means at least 51% of customers will get a purchase rate of 39.9% per year, but that could vary based on individual circumstances.

Business Credit Card

Representative APR 29.9% (variable), Purchase rate 29.9% p.a. (variable), Assumed credit limit £1,200, Annual Fee £0

This means at least 51% of customers will get a purchase rate between 19.9% and 29.9% per year, but that could vary based on individual circumstances.

-

Compound interest is the earning or charging of interest on interest and can be applied for both savings and lending. For savings accounts, compound interest means you earn interest from previously earned interest. This makes your savings grow exponentially.

For some forms of lending such as credit cards, compound interest applies when you don’t pay your balance off in full each month. If you have an outstanding balance, you’ll have to pay interest on both the initial amount you borrowed, plus interest already charged that you’re still paying off.

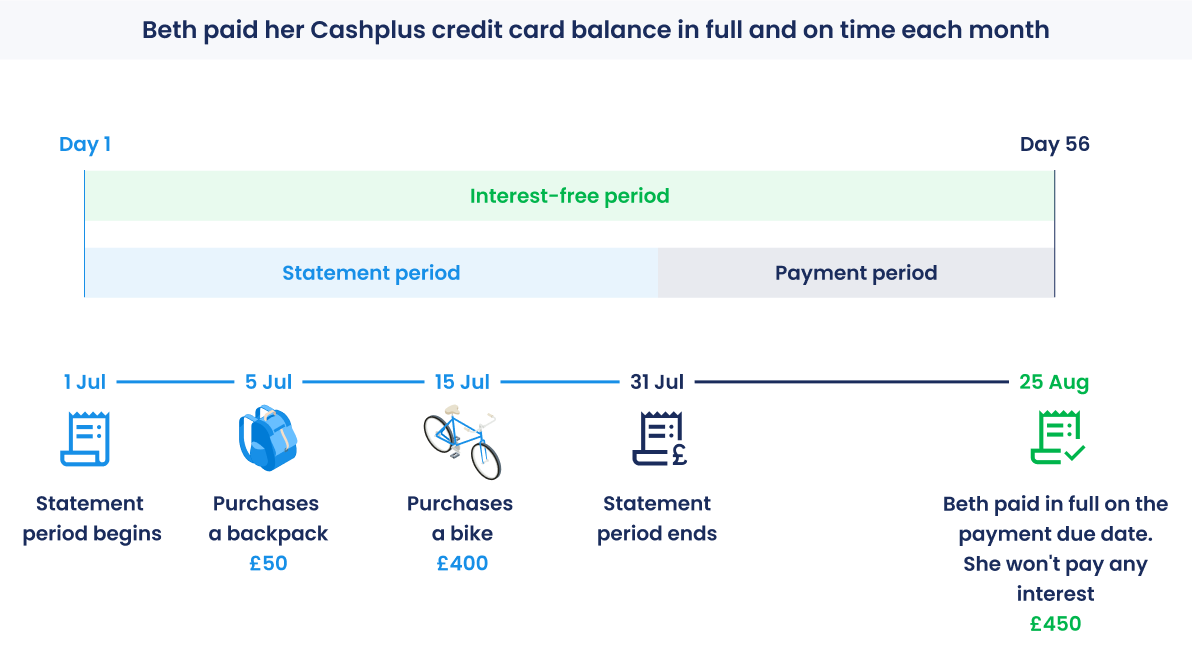

How do interest free days work for Credit cards?

Most credit cards offer an interest free period on the purchases you make. This is the maximum number of days between you buying something with your credit card and you repaying that amount, before we charge interest on it.

We’ll give you an example using the interest free period for a Cashplus credit card.

If you pay your credit card balance in full and on time each month, we’ll give you up to 56 days interest free credit on any purchases you make. This means you don’t have to pay interest on anything you buy until up to 25 days after the end of that month’s statement period.

- Up to 31 days in a month + 25 days extra = up to 56 days interest free

If you only make the minimum or a partial payment on your credit card, you’ll lose your interest free period and will have to pay interest on your unpaid purchase(s) from the date of the purchase until you repay it in full.

Terms and Conditions apply, including applicants being resident in the UK & aged 18+ and, if relevant, businesses being based in the UK.

For full website terms including information on Cashplus Bank, Mastercard and use of Trademarks, please see our full legal disclosures at https://www.cashplus.com/legal/.

Advanced Payment Solutions Limited (APS), trading as Cashplus Bank, is registered in England and Wales at Cottons Centre, Cottons Lane, London SE1 2QG (No.04947027). APS is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under Firm Reference Number 671140.

APS provides credit facilities subject to approval and affordability, and where accounts continue to meet APS credit criteria.