Throughout life, there will be times where you or someone else need support to manage their bank account.

Third party access covers the different ways you trust – a ‘third party’ – to help manage your Cashplus account when you’re not able to. For example, a stay in hospital, loss of mental capacity or planning for a time when you may not be able to manage on your own.

Step 1: Choose the right option for you

Decisions like this can have a significant impact on your life and wellbeing, or someone you’re close to, so please consider your options carefully. You can also make changes to third party access in the future.

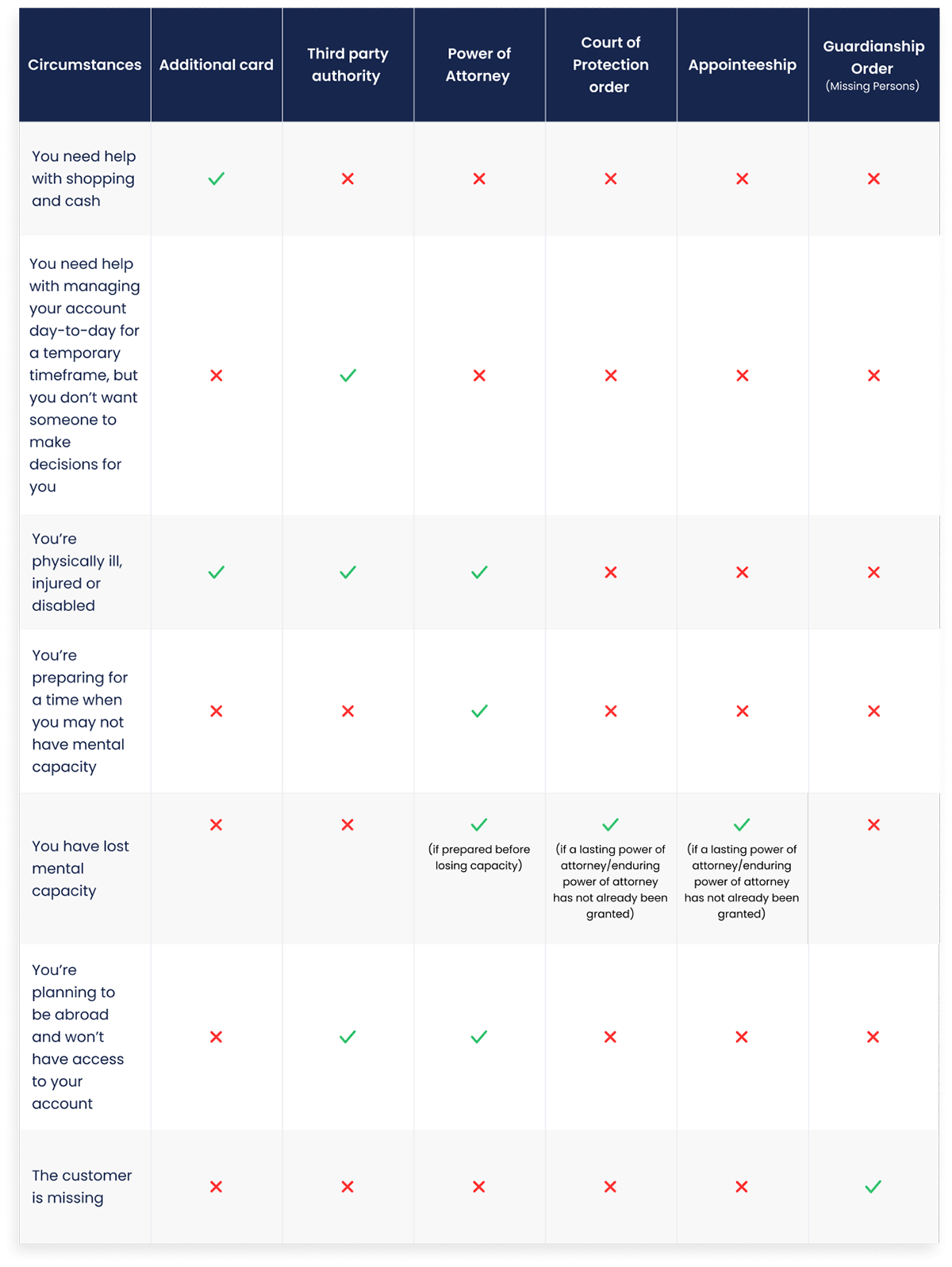

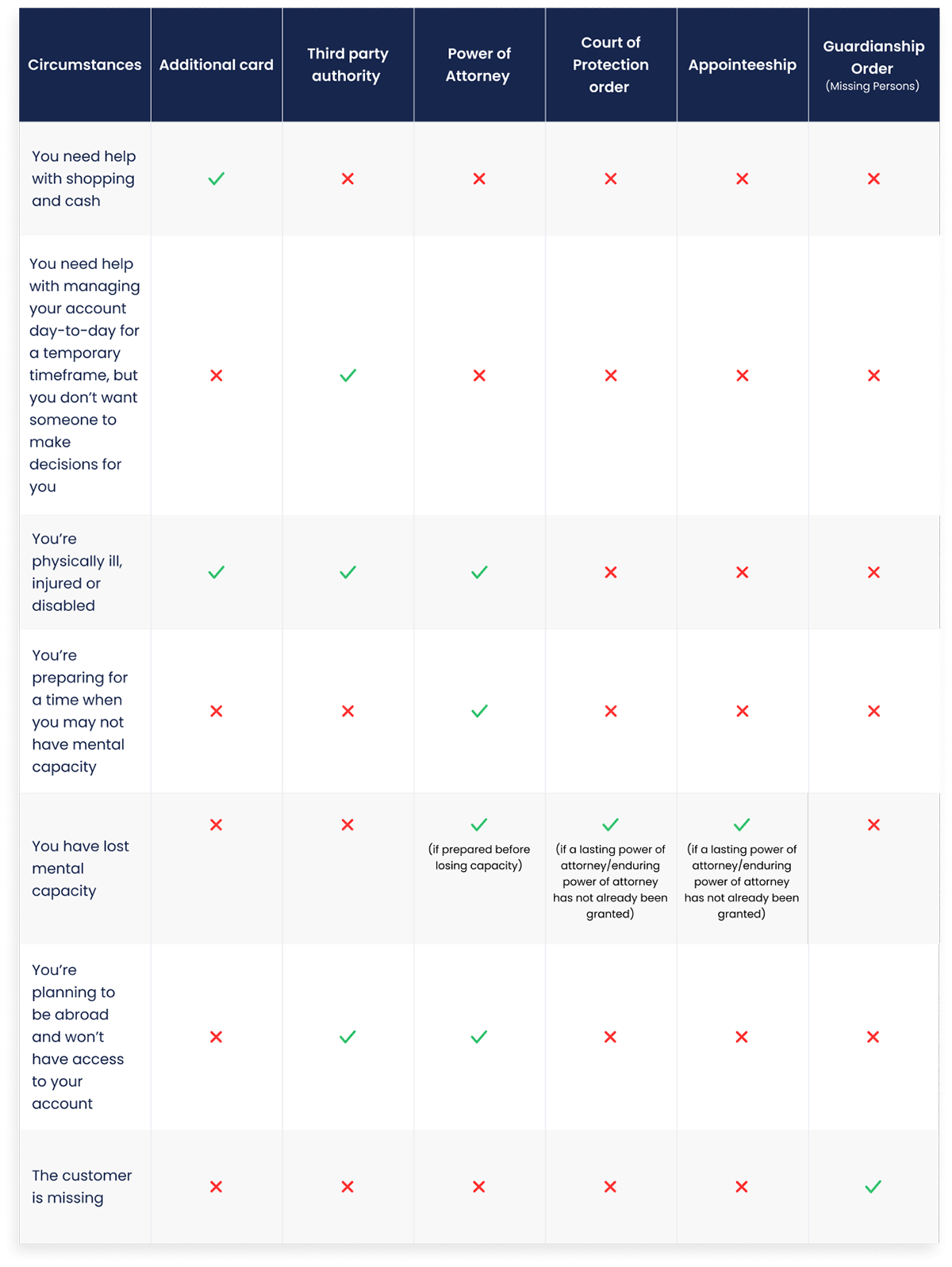

Read the options below to find out more. If you’re not sure, you can view our comparison table at the bottom of the page.

Third Party Authority

If you have a Cashplus account, you can add third party access. This allows another person access to your account for short or extended timeframe.

Power of Attorney

If you're looking to register a Power of Attorney with Cashplus to help manage someone's account, or you're not sure where to start, we're here to offer you help and support

Court of Protection order

A Court of Protection Order appoints a deputy for someone who has lost capacity

Appointeeship

This is a delegate to manage benefits from Department of Work and Pensions (DWP)

Guardianship Order (Missing Persons)

This is a court appointed guardian of a missing person’s financial affairs

Additional cards

If you’re looking to add a card for carer to help with your shopping and cash

Important reminder: if you allow third party access to your account, you're still responsible for anything your chosen person does with it.

Step 2: Setting up or changing third party access

Once you know which type of third party access you need, you'll need to register the third party with us. You'll also need to contact us when you want to make any changes.

Extra help and support

-

Office of the Public Guardian: https://www.gov.uk/government/organisations/office-of-the-public-guardian

Citizens Advice Bureau: https://www.citizensadvice.org.uk/

AgeUK: https://www.ageuk.org.uk/

Mental Health Foundation: https://www.mentalhealth.org.uk/

Mind Charity: https://www.mind.org.uk/

Alzheimer’s Society: https://www.alzheimers.org.uk/

Carers Trust: https://carers.org/

More information on Financial Abuse.

-

Appointee

A person appointed by the Department for Work and Pensions to act on behalf of an individual receiving state benefits but isn’t able to manage their benefit-related affairs due to mental incapacity or severe physical disability.

Attorney

A person or group of people appointed to manage the finances or property of another person. An attorney may under one of the following types of powers of attorney: ordinary, lasting, or enduring.

Deed of revocation

A formal document which can be used to cancel a lasting power of attorney or an unregistered enduring power of attorney, depending on the situation. You can find more information on the GOV.UK website.

Deputy

A person or group of people appointed by the Court of Protection to manage the affairs of a person who has lost capacity to make decisions for themselves. You can find more information on GOV.UK website. Before 1 October 2007 a person appointed by the Court of Protection to act on behalf of an individual who had lost capacity was called a 'receiver'.

Donor

A person who wishes to give another person the authority to act or make decisions on their behalf.

"Jointly" and "Jointly and severally"

In some situations, there may be multiple third parties representing an individual regardless of the type of third party access they have been granted (i.e. third party mandate or power of attorney). They may be appointed to act "jointly" or "jointly and severally". Appointing multiple representatives to act "jointly" means that they must all make decisions together, while appointing them to act "jointly or severally" means that they can make decisions together or alone. You may also hear the term "jointly and individually" used instead of "jointly and severally".

Third party

When we say ‘third party’, we are referring to an individual acting on behalf of someone else under a formal instruction such as a third party authority, power of attorney, Court of Protection order or Department for Work and Pensions appointment.

Understanding third party access

Third party access may help in the situations below

Terms and Conditions apply, including applicants being resident in the UK & aged 18+ and, if relevant, businesses being based in the UK.

For full website terms including information on Cashplus Bank, Mastercard and use of Trademarks, please see our full legal disclosures at https://www.cashplus.com/legal/.

Advanced Payment Solutions Limited (APS), trading as Cashplus Bank, is registered in England and Wales at Cottons Centre, Cottons Lane, London SE1 2QG (No.04947027). APS is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under Firm Reference Number 671140.

APS provides credit facilities subject to approval and affordability, and where accounts continue to meet APS credit criteria.