Taking you from stop to go in minutes.

-

Apply straight from your mobile

-

No credit check during sign up

-

Instant online decision

-

Account Number and Sort Code

-

Get your card within 3-5 working days

First things first

Let’s get straight to the point. There are certain features you just expect from a bank account.

But beyond same day payments, a unique account number and a Bank App, we’ve come up with a little something extra.

And the good news is we've focused on making signing up the easiest and fastest it can be - so opening your bank account can be as quick and painless as ordering a cup of coffee.

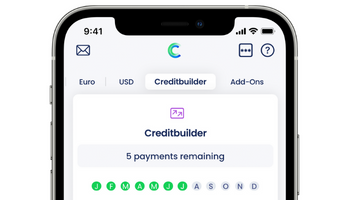

Creditbuilder

The first of its kind in the UK. Add it onto the Activeplus bank account and it could help build your credit rating at no extra cost. Find out more about the Cashplus Creditbuilder.(available with the Activeplus account)

Contactless Mastercard

Pay your way online, instore and over the phone in over 200 countries worldwide – wherever you see the Mastercard acceptance mark.

Post Office Branch Services

We've teamed up so you can deposit cash into your account at any UK branch. Money is available in your account immediately.

Not your average Bank app

Ever find yourself frustrated because there are so many things you (still) have to login via your PC for? Not anymore. The Cashplus Bank app is fully equipped with every feature of our Online banking site. Add new payees, get spending insights and add cards – simple.

Your money matters

Any funds you deposit into a Cashplus Business Bank Account are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000.

The Fine Print

We want you to have all the information you need, so you can make the choice that’s right for you.

Our Personal Bank Account has two different pricing levels.

We’ve tailored them to how our customers typically use our accounts, to make sure we can offer a solution that’s going to work for you.

Find out about the Cashplus Personal Bank account service information

Terms and Conditions apply, including applicants being resident in the UK & aged 18+ and, if relevant, businesses being based in the UK.

For full website terms including information on Cashplus Bank, Mastercard and use of Trademarks, please see our full legal disclosures at https://www.cashplus.com/legal/.

Advanced Payment Solutions Limited (APS), trading as Cashplus Bank, is registered in England and Wales at Cottons Centre, Cottons Lane, London SE1 2QG (No.04947027). APS is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under Firm Reference Number 671140.

APS provides credit facilities subject to approval and affordability, and where accounts continue to meet APS credit criteria.