Bank App Guide

It’s simple and easy to manage your money with the Cashplus Bank App. Here’s how.

For many of us, mobile devices and apps are a useful way to get tasks done quickly and on the go, including when it comes to managing your money. The Cashplus Bank App has some great features to help you organise your finances with ease. Here’s a quick rundown of some key features and exactly how they work! Don’t have the app yet? You can download it from the App Store or Google Play today.

Setting up and logging in to the Bank App

Learn how to log in to the Bank app and take control of your money. You can also download our printable step-by-step guide to logging in to the Bank app for the first time.

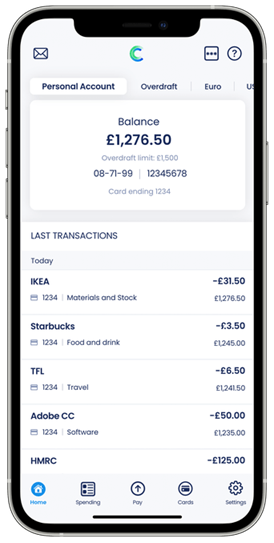

To view your balance and available balance, simply go to the ‘Home’ tab in the Cashplus Bank App.

Using the Cashplus Bank App, you can make immediate payments and set up payments for the future.

If you’d like to pay a friend, family member or someone else:

- Tap on the ‘Pay’ tab at the bottom of the screen

- Select ‘Make a Payment’

- If you've paid this person before, you can find their name in the list and tap to proceed with payment (if it’s a new payee, see our ‘How to set up a payee’ guide below)

- Enter the amount that you’d like to pay

- Enter a reference (this will appear on your statement and the payees)

- Select the type of payment - for an existing payee, the reference you set for the original transaction will appear here

- One off immediate payment

- One off future payment

- Repeat until a date

- Repeat for a number of payments

- Repeat until cancelled

- Depending on the option you choose, enter any additional information related to dates, frequency and number of payments

- Tap Confirm to review the summary of your payment

- If all the information is correct, click Pay

- You may be asked to complete extra security steps. Once completed correctly, your payment will be processed.

Setting up a payee can make your payments a lot easier, especially if you’re sending payments to someone on a regular basis. Here’s how to set one up within the app:

- Tap on the ‘Pay’ tab at the bottom of the screen

- Select ‘Make a Payment’ and then, depending on your device:

- iOS users: select 'Add new Payee'

- Android users: tap the green ‘+’ icon

- You’ll then be asked to verify yourself (either by re-entering your password, or by using biometrics)

- To help avoid fraud, we'll ask you to check and confirm you want to add this payee

- Enter in the relevant payee information

- You have the option to select someone as a ‘trusted payee’ (ideal for someone you make payments to regularly). Making someone a trusted payee means one less security step next time you pay this person, saving you a little extra time.

- Confirm you understand and want to save payee

- Follow the instructions to complete payment. If you’re an iOS user, you’ll need to select your payee from your payee list and follow payment steps

- To edit or delete a payee:

- iOS users: To edit or delete a payee, go to the 'Manage my payees' screen and swipe from right to left on the payee name.

- Android users: To edit or delete a payee, go to ‘Add and Manage Payees’, select the payee you’d like to edit or delete and follow the steps

Stay in the know with payment notifications via the Cashplus Bank App. Check to make sure you have app notifications enabled in the app (via Settings > Manage Notifications) and in your phone settings. Here's how to set up these alerts:

- Log in to the Cashplus Bank App

- Go to 'Settings' and select 'Manage Notifications'

- Under 'Payments & transfers', switch on 'App notifications' by swiping the toggle from left to right so it goes green

- Check your phone settings to make sure it allows app notifications from the Cashplus Bank App

Whether you’re doing a tax return, or you just want to keep a record of your spending, it’s easy to download statements in the app.

- Tap on the ‘Spending’ tab

- If you have multiple cards, select the card by using the 'Card' dropdown

- Select the month you’d like to access (the default is the last 30 days) via the dropdown in the top left corner

- Tap on the download icon in the top right corner

- Select the dates you want to export

- Select which file you’d like and download!

- You can only download statements from the past 18 months. If you need statements from further back, please contact our Customer Services Team and they’ll be able to help you out.

Misplaced your card? No worries. Whether it’s been stolen or simply slipped under the couch cushion, you can block and unblock your Cashplus debit card in the app with a few simple taps:

- Head to the ‘Cards’ tab

- Select the card that you wish to block

- Select ‘Block card’

- Select whether you want to mark it as lost, stolen or as a temporary block

If you have a Cashplus Credit Card, please call our team if you need to block your card.

How to block gambling payments

With many of us staying at home, whether it’s the result of job changes or self-isolation, the temptation to gamble can increase. Being able to turn off gambling transactions on your Cashplus Bank Account gives you extra control of your funds.

- Head to the ‘Cards’ tab

- Select the Card that you wish to apply the block on

- Select ‘Transaction controls’

- Turn on ‘Block gambling transactions’

And that’s just a few of the ways you can manage your money easier with the Cashplus Bank App. We’re always working on improving and updating the app, so keep any eye on our Facebook and Twitter pages for any new feature updates!

If you’re a Cashplus customer but don’t yet have the app, download it using the links below:

Prefer using a laptop or other device for managing your money? Learn the basics of Cashplus Online Banking.

Want to add a trusted cardholder to your Cashplus Bank account? Find out about additional cards here.

This content was created on 4th August 2020

Terms and Conditions apply, including applicants being resident in the UK & aged 18+ and, if relevant, businesses being based in the UK.

For full website terms including information on Cashplus Bank, Mastercard and use of Trademarks, please see our full legal disclosures at https://www.cashplus.com/legal/.

Advanced Payment Solutions Limited (APS), trading as Cashplus Bank, is registered in England and Wales at Cottons Centre, Cottons Lane, London SE1 2QG (No.04947027). APS is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under Firm Reference Number 671140.

APS provides credit facilities subject to approval and affordability, and where accounts continue to meet APS credit criteria.